beerconnoisseur- The Michigan Brewers Guild presented the 2017 Tom Burns Award to Rex Halfpenny, publisher of the Michigan Beer Guide, at its annual conference on Thursday, January 12 at the Radisson Plaza Hotel in Kalamazoo. This is the 20th Anniversary of the Michigan Beer Guide and the Michigan Brewers Guild.

The Tom Burns Award is given to a person who embodies the pioneering spirit of the Michigan brewing industry. This is an individual whose hard work, passion, and perseverance has been a guiding force in creating the Great Beer State while being supportive of the entire craft beer industry in Michigan. Nominees can be brewery owners or employees, can be affiliated with a beer wholesaler or beer retailer or otherwise involved in the industry. Nominees can be part of the industry now or in the past and do not need to be currently living.

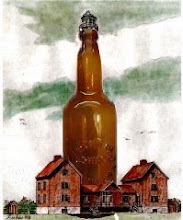

It is named after Detroit & Mackinac Brewing Company founder and brewer, Tom Burns, who passed away of cancer May 1, 1994. Burns, a “recovering attorney” whose passion was brewing, is credited with many of the advancements in brewing legislation, rules, and regulations in the 1990s which paved the way for a thriving industry. more- rex-halfpenny-2017-tom-burns-award

Tuesday, January 24, 2017

Thursday, January 19, 2017

U.S. Breweries at a Record High of 7,190 in 2016

emalt- For the third straight year, the Alcohol and Tobacco Tax and Trade Bureau issued more than 1,000 new brewery permits, bringing the total number of permitted U.S. breweries to a record high of 7,190 in 2016, Brewbound.com reported on January 17.

According to recent TTB data published by National Beer Wholesalers Association chief economist Lester Jones, the number of permitted U.S. breweries has tripled from 2,343 over the last six years.

The government agency issued 1,110 new permits in 2016, down slightly from the 1,142 new permits issued in 2015.

Permitted breweries include brick and mortar facilities and alternating proprietorships while excluding contract brewers. It also includes brewers who may have recently shut down their brewing operations but have not yet been “delisted” by the TTB.

As of December 31, 2016, California had the most permitted breweries in the U.S., at 927, and Washington, D.C., had the fewest with 13.

According to Jones, California’s 927 permitted breweries is “almost as many as the entire U.S. total of 974 permits in 1995.”

Similarly, the TTB counted 264 total permitted breweries in Florida last year, which is 14 more than the 1990 national count of 250, according to Jones.

On a national basis, there are now 2.2 breweries per 100,000 residents, up from 0.7 per 100,000 residents in 2010. And, at the state level, Vermont has the highest number of breweries per capita, at 11.7, followed by Maine (7.7), Montana (7.6) and Colorado (7.0), Jones reported.

“Around the country, per capita brewery measures in many states have more than tripled since 2010,” he wrote.

But as overall beer consumption continues decline, Jones said he believes the increasing number of permitted breweries will only create stiffer competition in an already crowded beer category.

According to recent TTB data published by National Beer Wholesalers Association chief economist Lester Jones, the number of permitted U.S. breweries has tripled from 2,343 over the last six years.

The government agency issued 1,110 new permits in 2016, down slightly from the 1,142 new permits issued in 2015.

Permitted breweries include brick and mortar facilities and alternating proprietorships while excluding contract brewers. It also includes brewers who may have recently shut down their brewing operations but have not yet been “delisted” by the TTB.

As of December 31, 2016, California had the most permitted breweries in the U.S., at 927, and Washington, D.C., had the fewest with 13.

According to Jones, California’s 927 permitted breweries is “almost as many as the entire U.S. total of 974 permits in 1995.”

Similarly, the TTB counted 264 total permitted breweries in Florida last year, which is 14 more than the 1990 national count of 250, according to Jones.

On a national basis, there are now 2.2 breweries per 100,000 residents, up from 0.7 per 100,000 residents in 2010. And, at the state level, Vermont has the highest number of breweries per capita, at 11.7, followed by Maine (7.7), Montana (7.6) and Colorado (7.0), Jones reported.

“Around the country, per capita brewery measures in many states have more than tripled since 2010,” he wrote.

But as overall beer consumption continues decline, Jones said he believes the increasing number of permitted breweries will only create stiffer competition in an already crowded beer category.

Sunday, January 1, 2017

2016 Hop Crop Value Soars

emalt- Hop crop value soars 44% this year

US hop farmers have celebrated record revenues from their crops in 2016 as they planted more acres despite signs that the craft beer boom, which has boosted demand for the key brewing ingredient, may be peaking, the Financial Times reported on December 19.

The value for the year’s hop crop soared 44 per cent this year from 2015, totalling just short of $500 mln, according to the US Department of Agriculture. “Higher hop acreage and production” and the continued trend to shift hop production to more expensive varieties favoured by craft beer makers were behind the jump, said the USDA in its latest report on hop output.

Craft brewers use four-to-ten times more hops than the amount used in the average lager produced by multinational brewers, and the surge in popularity for microbrews, which are high in flavour and aroma, has pushed up demand and prices for certain speciality hops. Nevertheless, as farmers push to plant more hops, US consumption of craft beer may be slowing.

US hop farmers have celebrated record revenues from their crops in 2016 as they planted more acres despite signs that the craft beer boom, which has boosted demand for the key brewing ingredient, may be peaking, the Financial Times reported on December 19.

The value for the year’s hop crop soared 44 per cent this year from 2015, totalling just short of $500 mln, according to the US Department of Agriculture. “Higher hop acreage and production” and the continued trend to shift hop production to more expensive varieties favoured by craft beer makers were behind the jump, said the USDA in its latest report on hop output.

Craft brewers use four-to-ten times more hops than the amount used in the average lager produced by multinational brewers, and the surge in popularity for microbrews, which are high in flavour and aroma, has pushed up demand and prices for certain speciality hops. Nevertheless, as farmers push to plant more hops, US consumption of craft beer may be slowing.

InBev To Export Craft

emalt - Anheuser-Busch InBev is making a number of sizable investments to grow its acquired craft beer brands both domestically and abroad, according to recent reports.

The world’s largest beer company is planning a large-scale international expansion for its biggest craft offering, Goose Island, and making significant investments to scale production capabilities for its Blue Point and Karbach Brewing brands in their respective home markets of New York and Texas.

According to the Chicago Tribune, Goose Island’s global strategy will begin to materialize in 2017, as it begins operating outposts in six countries, including:

•Sao Paulo, Brazil,

•Seoul South Korea,

•Shanghai, China

•Monterrey, Mexico

•Toronto, Canada

•London, England

“It’s plain and simple — if we don’t do it, somebody else is going to,” Goose Island President Ken Stout told the Tribune.

In addition to increased product availability and the potential to brew large-scale batches of Goose Island beer at AB InBev breweries abroad, physical expansion takes three forms: Goose Island Brewhouses, Vintage Ale Houses and branded Goose Island pubs.

The world’s largest beer company is planning a large-scale international expansion for its biggest craft offering, Goose Island, and making significant investments to scale production capabilities for its Blue Point and Karbach Brewing brands in their respective home markets of New York and Texas.

According to the Chicago Tribune, Goose Island’s global strategy will begin to materialize in 2017, as it begins operating outposts in six countries, including:

•Sao Paulo, Brazil,

•Seoul South Korea,

•Shanghai, China

•Monterrey, Mexico

•Toronto, Canada

•London, England

“It’s plain and simple — if we don’t do it, somebody else is going to,” Goose Island President Ken Stout told the Tribune.

In addition to increased product availability and the potential to brew large-scale batches of Goose Island beer at AB InBev breweries abroad, physical expansion takes three forms: Goose Island Brewhouses, Vintage Ale Houses and branded Goose Island pubs.

Subscribe to:

Comments (Atom)